Ethereum, the second-largest cryptocurrency by market capitalization, has been showing some interesting on-chain data that could potentially signal the peak of the current market cycle. Historically, one of the indicators that have predicted previous market peaks for Ethereum is the netflows for wallets associated with the Ethereum Foundation, a non-profit entity supporting the cryptocurrency and its ecosystem.

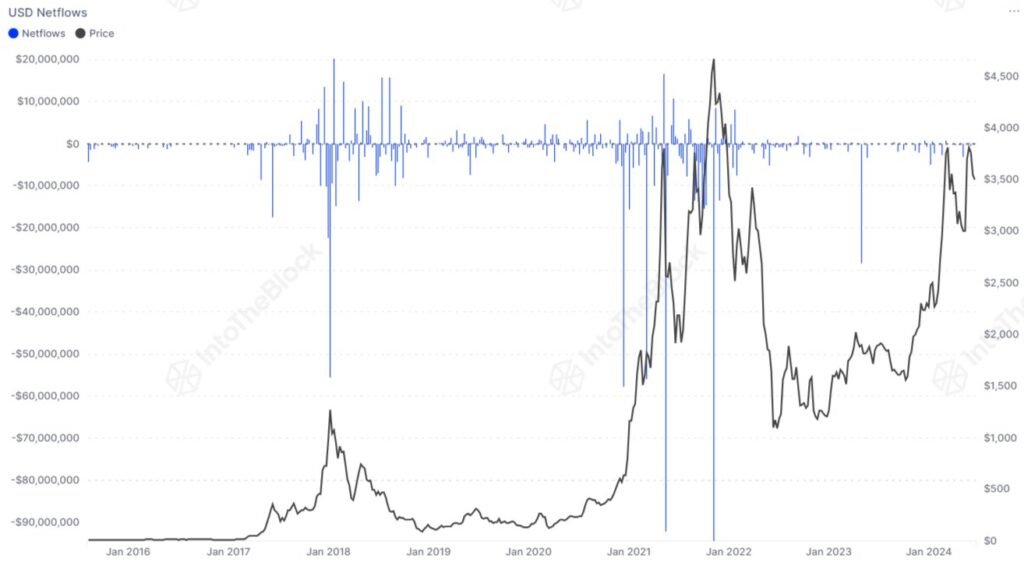

The chart shared by market intelligence platform IntoTheBlock shows that during past bull markets, the net amount of ETH moving in or out of wallets connected to the Ethereum Foundation has generally been negative. Negative netflows indicate a movement of ETH away from the organization’s wallets, which has coincided with market peaks in the past. This strategic selling by the Foundation has often aligned with the cryptocurrency’s peak prices.

However, in the current market cycle, the netflows for the Ethereum Foundation have been more or less neutral, despite Ethereum’s significant price increase. This suggests that the organization has not been making major sales during this bull market. This lack of significant outflows could indicate that the cryptocurrency has not yet reached its peak, according to historical patterns. Alternatively, it is possible that the Foundation has changed its strategy for this cycle, making past trends less relevant.

In other news, the official email of the Ethereum Foundation was recently compromised, as disclosed by ETH developer Tim Beiko. The organization was working to resolve the issue with an email automation service provider and sent out updates to subscribers warning them about the compromise. The compromised email had announced a “staking platform” by the Foundation, which was not legitimate. While the team is still confirming the extent of the breach, steps have been taken to secure external access.

On the price front, Ethereum experienced a dip below $3,300 recently but has since recovered above $3,400. The volatility in the cryptocurrency market is common, and price fluctuations are to be expected. Investors and traders in the Ethereum ecosystem should monitor on-chain data and relevant indicators to make informed decisions about their positions in the market. It will be interesting to see how the Ethereum Foundation’s wallet netflows continue to evolve in relation to the price of the cryptocurrency in the coming weeks and months.