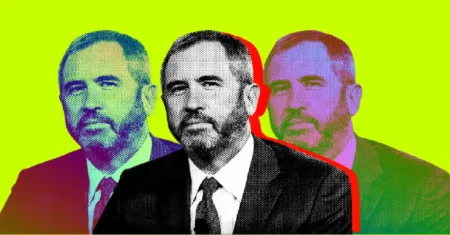

In November, the Securities and Exchange Commission (SEC) released a litigation update involving a $115 million securities fraud scheme. Eng Taing and his company, Touzi Capital, LLC, were accused of deceiving investors by promising high returns from investments in crypto mining operations and debt rehabilitation businesses. Taing allegedly misled investors by presenting these investments as secure and lucrative opportunities. This case highlights the importance of due diligence and caution when investing in the crypto market.

The SEC’s investigation into Eng Taing and Touzi Capital, LLC underscores the need for regulatory oversight in the crypto space. With the growing popularity of cryptocurrencies, investors are at risk of falling victim to fraudulent schemes. The SEC’s involvement in this case serves as a reminder that scams and fraudulent activities are prevalent in the crypto market, and investors should be vigilant when considering their investment options. By exercising caution and conducting thorough research, investors can protect themselves from falling prey to such schemes.

Eng Taing’s alleged securities fraud scheme sheds light on the challenges and risks associated with investing in the crypto market. While cryptocurrencies can offer high returns, they also come with a high level of risk due to their volatile nature and lack of regulation. Investors should be aware of the potential pitfalls and conduct proper due diligence before making any investment decisions. Engaging with reputable and regulated investment platforms can help mitigate risks and safeguard investors against fraudulent activities.

The SEC’s enforcement action against Eng Taing highlights the agency’s commitment to cracking down on fraudulent activities in the crypto space. By holding individuals and companies accountable for deceptive practices, the SEC aims to protect investors and maintain the integrity of the financial markets. This case serves as a warning to those who engage in fraudulent activities in the crypto market that they will face consequences for their actions. Investors should be cautious and wary of promises of high returns that seem too good to be true, as they may be a red flag for potential fraud.

In light of the SEC’s litigation release involving Eng Taing and Touzi Capital, LLC, investors should exercise caution and conduct thorough due diligence when considering investments in the crypto market. By vetting investment opportunities and engaging with regulated platforms, investors can reduce their exposure to fraudulent schemes and protect their assets. The SEC’s enforcement actions serve as a deterrent to those looking to deceive investors and perpetrate fraudulent activities in the crypto space. By staying informed and vigilant, investors can navigate the complex world of cryptocurrencies with confidence and make informed investment decisions.

Overall, the SEC’s enforcement action against Eng Taing and Touzi Capital, LLC serves as a reminder of the risks and challenges associated with investing in the crypto market. While cryptocurrencies offer exciting opportunities for high returns, they also come with a high level of risk due to their speculative nature and lack of regulation. By staying informed, conducting thorough research, and engaging with reputable investment platforms, investors can protect themselves from falling victim to fraudulent schemes and make sound investment decisions in the rapidly evolving world of cryptocurrencies.