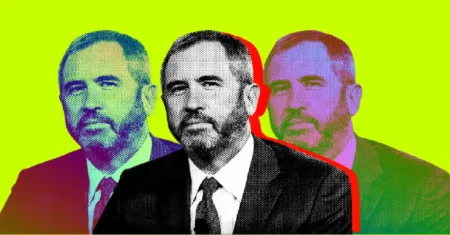

Roger Ver, a well-known figure in the cryptocurrency world, has recently filed a motion to dismiss an eight-count U.S. tax indictment against him. Dubbed as “Bitcoin Jesus,” Ver was arrested earlier this year in Barcelona after the indictment accused him of tax evasion. In his motion, Ver argues that the charges are based on unconstitutional government overreach and misuse of evidence. He is seeking to have the indictment dismissed in its entirety. Ver’s legal battle highlights the complexities and legal challenges faced by prominent figures in the cryptocurrency space.

The 45-year-old entrepreneur has been a vocal advocate for cryptocurrency and blockchain technology for several years. He was an early investor in Bitcoin and has been instrumental in promoting the adoption of digital currencies around the world. Ver’s involvement in the industry has made him a controversial figure, with supporters praising his vision and detractors accusing him of promoting illegal activities. The tax indictment against Ver is seen as a major test case for the legal status of cryptocurrencies and the boundaries of government regulation in the digital asset space.

Ver’s motion to dismiss the tax indictment is based on several key arguments. He claims that the charges are unconstitutional because they violate his rights to privacy and due process. Ver also alleges that the evidence used to support the indictment was obtained illegally and should be excluded from the case. Additionally, Ver argues that the government’s interpretation of tax laws related to cryptocurrencies is flawed and overly broad. His legal team is confident that they will be able to successfully defend against the allegations and have the charges dropped.

The outcome of Ver’s legal battle could have significant implications for the cryptocurrency industry as a whole. The case has drawn attention to the challenges faced by individuals and businesses operating in the digital asset space, as well as the limitations of current regulatory frameworks. Ver’s defense team is expected to present a strong case in support of dismissing the indictment, citing legal precedents and expert testimony to bolster their arguments. If successful, Ver’s motion could set a precedent for future cases involving taxes and cryptocurrencies.

Despite the complexities of the case, Ver remains upbeat and confident in his legal defense. He has expressed his resolve to fight the charges and clear his name, emphasizing his commitment to transparency and accountability in all his dealings. Ver’s supporters have rallied behind him, praising his courage and determination in the face of adversity. The outcome of the case is eagerly awaited by the cryptocurrency community, with many hoping that a favorable ruling for Ver will help clarify the legal landscape for digital assets and pave the way for greater acceptance and innovation in the industry.

In conclusion, Roger Ver’s motion to dismiss the U.S. tax indictment against him represents a significant development in the legal challenges facing prominent figures in the cryptocurrency world. His defense strategy highlights the constitutional issues and regulatory uncertainties surrounding cryptocurrencies and government oversight. Ver’s case is being closely watched by industry experts and observers, who see it as a potential turning point in the ongoing debate over the legal status of digital assets. With his reputation and freedom at stake, Ver is determined to fight the charges and set a precedent for future cases involving taxes and cryptocurrencies. The outcome of his legal battle could have far-reaching implications for the cryptocurrency industry and shape the future of government regulation in the digital asset space.