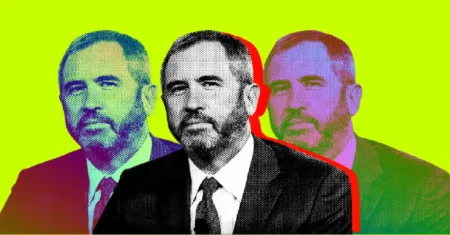

Ripple CEO Brad Garlinghouse recently criticized SEC Chairman Gary Gensler for his comments about crypto executives potentially going to jail. Gensler expressed concerns about the lack of compliance in the crypto space and mentioned that several top crypto executives are either in jail or awaiting sentencing. This led Garlinghouse to accuse Gensler of spreading “absolute nonsense” and claimed that his approach to crypto regulation could cause President Joe Biden to lose the upcoming elections. The Ripple CEO highlighted Gensler’s failure to address fraudulent schemes in the crypto industry and suggested that his incompetence could lead to negative consequences for Biden.

During an interview with Bloomberg, Gensler discussed various aspects of the U.S. crypto industry, including the upcoming launch of Ethereum ETFs and the need for stricter regulation. While he did not provide a timeline for the ETF launch, Gensler emphasized the importance of compliance with securities laws in the crypto space. He also pointed out that non-compliance has resulted in significant harm to American investors and highlighted the number of crypto executives facing legal consequences. Gensler’s comments have stirred controversy within the crypto community, with Garlinghouse and others criticizing his stance on regulation and its potential impact on the upcoming elections.

Garlinghouse specifically called out Gensler for his handling of the FTX bankruptcy and his relationship with Sam Bankman-Fried, the platform’s founder who was sentenced to 25 years in prison for his involvement in fraudulent activities. The Ripple CEO also highlighted Gensler’s absence from the Department of Justice’s announcement of a multi-billion-dollar settlement with Binance, the world’s largest crypto exchange. By pointing out these instances of alleged incompetence, Garlinghouse suggested that Gensler’s actions could undermine Biden’s chances of winning the elections, especially among young American citizens who are involved in the crypto industry.

The rift between Garlinghouse and Gensler reflects broader concerns within the crypto community about regulatory overreach and its potential impact on the industry. Many in the crypto space are wary of increased scrutiny from regulators like the SEC, fearing that it could stifle innovation and hinder the growth of the industry. Gensler’s comments about non-compliance and his focus on enforcement have further fueled these concerns, leading to tensions between industry leaders and regulators. As the debate over crypto regulation continues, the outcome of the upcoming elections could have significant implications for the future of the industry and its relationship with government authorities.

In conclusion, the controversy surrounding Gensler’s comments about crypto executives and their potential legal troubles has sparked a larger debate about the role of regulation in the crypto space. Garlinghouse’s criticism of Gensler’s approach to regulation and its impact on the upcoming elections highlights the growing tensions between industry leaders and government authorities. As the crypto industry continues to evolve and expand, finding a balance between innovation and compliance will be crucial for its long-term success. The outcome of the upcoming elections could shape the regulatory landscape for cryptocurrencies in the United States and beyond, making it a key issue for industry stakeholders and policymakers alike.