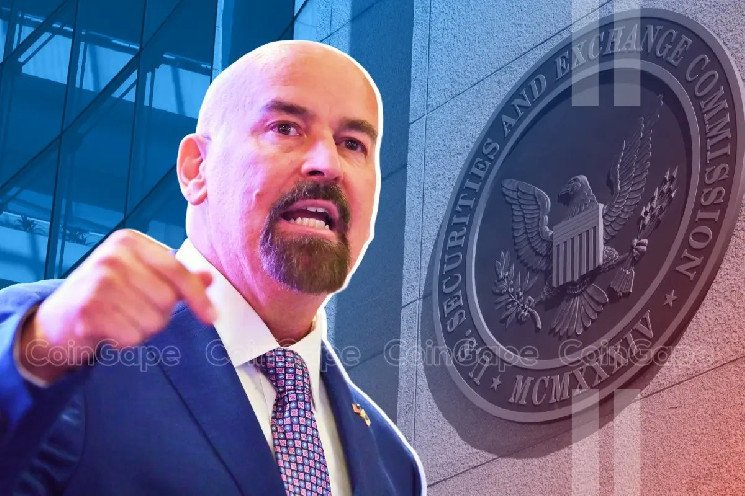

The recently finalized crypto tax reporting rule issued by the Biden administration has been met with criticism from lawyer John Deaton, who is known for his pro-XRP stance. The rule, titled “Gross Proceeds Reporting by Brokers that Regularly Provide Services Effectuating Digital Asset Sales,” was introduced by the IRS as a way to track and report transactions involving digital assets. However, Deaton argues that the regulation could have negative implications for decentralized finance (DeFi) and hinder its growth.

Deaton’s primary concern with the new rule is that it will impose reporting requirements on brokers that facilitate digital asset transactions, potentially stifling innovation in the DeFi space. DeFi platforms operate on the principle of decentralization, allowing users to interact directly with each other without the need for intermediaries like brokers. By imposing reporting requirements on these platforms, Deaton believes that the IRS is imposing unnecessary burdens that could discourage participation in DeFi.

Additionally, Deaton has expressed concern that the new rule could lead to privacy issues for users of decentralized exchanges and other DeFi platforms. Since the IRS will require brokers to report transaction details, including gross proceeds, to the agency, there is a risk that sensitive financial information could be exposed. This could deter individuals from using DeFi platforms out of fear that their personal and financial data could be shared with the government without their consent.

Despite his criticism of the new rule, Deaton acknowledges that tax compliance is important and understands the need for regulation in the crypto space. He has called for a more balanced approach that takes into account the unique characteristics of decentralized finance and the concerns of its users. Deaton suggests that the IRS work with industry stakeholders to develop a framework that allows for tax reporting without compromising the privacy and security of DeFi users.

In response to Deaton’s comments, the IRS has defended the new rule as necessary for ensuring tax compliance in the rapidly growing crypto market. The agency argues that the rule is aimed at closing the tax gap and preventing tax evasion, particularly in transactions involving digital assets. The IRS maintains that the reporting requirements are in line with existing tax regulations and are essential for maintaining the integrity of the tax system.

Overall, the debate over the new crypto tax reporting rule reflects the broader tensions between regulatory authorities and the decentralized nature of the crypto market. While tax compliance is important, there are legitimate concerns about the potential impact of regulations on innovation and user privacy in the DeFi space. As the crypto industry continues to evolve, it will be crucial for policymakers to strike a balance between enforcing tax laws and supporting the growth of decentralized finance in a way that protects the interests of all stakeholders.