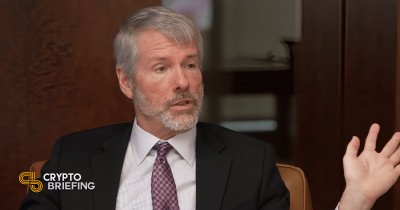

MicroStrategy co-founder and executive chairman Michael Saylor recently expressed his willingness to provide advisory support to President-elect Donald Trump on crypto matters if asked. In an interview with Bloomberg Open Interest, Saylor stated that he is open to providing insights on digital asset policy either privately or publicly and would consider serving on a Digital Assets Advisory Council if requested. While he confirmed meeting with individuals in the incoming Trump administration, Saylor did not disclose further details.

MicroStrategy is set to join the Nasdaq-100 alongside Palantir Technologies and Axon Enterprise, replacing other companies effective December 23. However, the company’s significant Bitcoin holdings could pose a risk to its index position. With a total of 439,000 BTC valued at approximately $45 billion, MicroStrategy may face reclassification as a financial company during the Industry Classification Benchmark (ICB) review in March. This reclassification would likely result in the company’s removal from the Nasdaq-100, which comprises non-financial firms.

Addressing concerns around the potential reclassification, Saylor emphasized that MicroStrategy is not solely dependent on its Bitcoin investments. The company’s software division generates a substantial operating income of about $75 million annually. Saylor also highlighted that MicroStrategy sees itself primarily as a Bitcoin Treasury company, with its primary focus on generating shareholder value through its Treasury operations. He mentioned that the company has a strong software division and no plans to spin it off, as it remains a core part of its identity.

MicroStrategy has been following a strategic acquisition strategy similar to other tech giants like Apple. With its 21/21 plan to fund future Bitcoin purchases, the company has already acquired around $17 billion worth of Bitcoin. At this pace, MicroStrategy could reach its $42 billion Bitcoin acquisition target by January 2025. Saylor indicated that the company would reassess its capital allocation strategy once this target is met and consider raising capital through fixed-income markets to enhance returns for common stock shareholders.

Despite MicroStrategy’s substantial Bitcoin investment leading to its inclusion in the Nasdaq-100, it may not meet the profitability requirements for entry into the S&P 500. The company has been profitable in only one of the past four quarters, a key criterion for S&P 500 inclusion. While upcoming changes by the Financial Accounting Standards Board could improve the company’s financial reporting, Bloomberg ETF analyst James Seyffart shared doubts about MicroStrategy’s potential inclusion in the S&P 500. Saylor remains optimistic about the company’s future prospects, citing potential billions of dollars in annual investment income that could lead to GAAP profitability and eventual inclusion in the S&P 500.