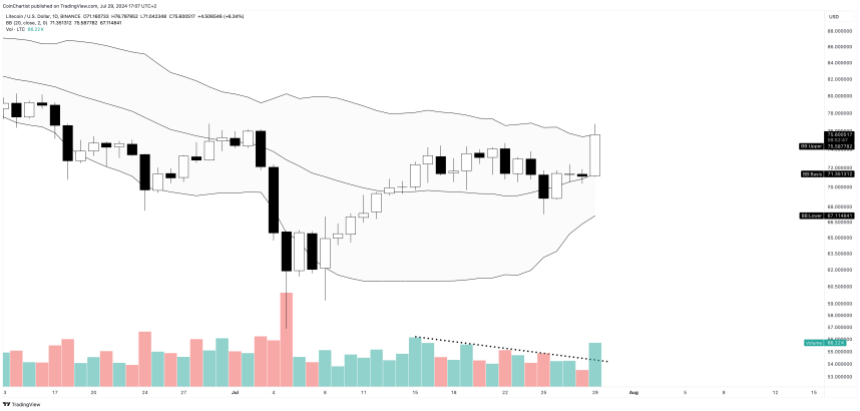

Litecoin has experienced a significant surge of 6% intraday, outpacing Bitcoin’s stagnant trend. This spike in LTCUSD has raised the possibility of a near-term buy signal based on the Bollinger Bands. This development could signal a more positive trend for the altcoin, potentially indicating brighter days ahead.

Litecoin’s journey has been tumultuous, especially following its massive rally in 2017 when it gained over 10,000% and secured a spot in the top ten cryptocurrencies by market cap. However, in recent years, Litecoin has struggled to maintain its position and is currently ranked number 18, hovering on the edge of the top 20. The sideways movement in price since the 2017 bull run has disappointed investors, but the current buy signal setup may offer a glimmer of hope for the altcoin.

The Bollinger Bands play a crucial role in assessing market volatility, acting not only as a technical indicator but as a complete trading system. These bands help traders gauge volatility by tightening and narrowing during periods of low volatility and expanding when volatility increases. In addition, the Bollinger Bands can generate buy and sell signals based on price movements relative to the upper and lower bands, which are set at a +2 standard deviation from the middle-line (a 20-period simple moving average). By surpassing the upper band with a 6% surge, LTCUSD has triggered a potential buy signal, which would be confirmed by a close above the upper band supported by higher-than-normal volume.

Tony Severino, CMT, author of the CoinChartist (VIP) newsletter, emphasizes the importance of technical analysis in understanding market movements. By closely monitoring indicators like the Bollinger Bands, investors can make informed decisions about buying and selling cryptocurrencies. Severino’s newsletter and market insights on Twitter and Telegram provide valuable educational content for those looking to enhance their trading skills and stay updated on market trends.

In conclusion, Litecoin’s recent rally and potential buy signal based on the Bollinger Bands offer hope for investors who have weathered the coin’s tumultuous journey in recent years. While past performance is not indicative of future results, technical indicators like the Bollinger Bands can provide valuable insights into market trends and potential entry points for traders. By staying informed and utilizing tools like the Bollinger Bands, investors can navigate the volatile cryptocurrency market with more confidence and potentially capitalize on emerging opportunities.