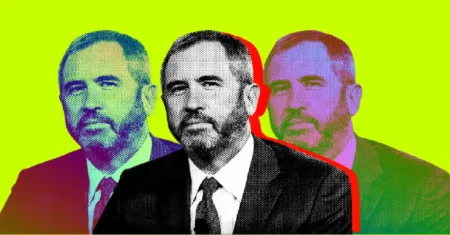

In a recent episode of CNBC’s Mad Money, host Jim Cramer expressed his long-standing support for cryptocurrencies such as bitcoin and ethereum. Citing their appeal in light of increasing U.S. debt and the ability to navigate fiscal challenges, Cramer emphasized the potential of these digital assets as key components of a diversified portfolio. Despite the volatility in the cryptocurrency market, Cramer’s endorsement highlights the growing acceptance and adoption of digital currencies as a legitimate investment option.

Cramer’s advocacy for bitcoin and ethereum comes at a time when the cryptocurrency market is experiencing heightened interest from investors and institutions. With the recent surge in the value of bitcoin and ethereum, many are turning to these digital assets as a means of diversifying their portfolios and hedging against inflation. As traditional markets continue to face uncertainty, cryptocurrencies offer a unique opportunity for investors to potentially capitalize on market trends and secure their financial future.

While Cramer’s endorsement of bitcoin and ethereum may come as a surprise to some, it is indicative of the growing mainstream acceptance of digital currencies. As more investors and institutions gravitate towards cryptocurrencies, the market is poised for continued growth and expansion. With the potential for significant returns and diversification benefits, bitcoin and ethereum are increasingly being seen as attractive assets for investors looking to build a robust and resilient portfolio in today’s evolving financial landscape.

One of the key reasons behind Cramer’s support for bitcoin and ethereum is the ongoing fiscal challenges facing the U.S. economy. With mounting debt and economic uncertainty, traditional assets may not provide the level of security and returns that investors are seeking. Cryptocurrencies, on the other hand, offer a decentralized and digital alternative that can potentially thrive in volatile market conditions. By including bitcoin and ethereum in a portfolio, investors can tap into the unique benefits of digital assets and position themselves for long-term growth and stability.

As the cryptocurrency market continues to gain traction, investors are increasingly looking towards digital assets as a way to diversify their portfolios and hedge against economic risks. With the endorsement of high-profile figures like Jim Cramer, bitcoin and ethereum are gaining mainstream recognition as legitimate investment options that can provide substantial returns and protection against market volatility. As more investors embrace cryptocurrencies, the market is expected to undergo further growth and evolution, solidifying its position as a key player in the global financial landscape.

In conclusion, Jim Cramer’s advocacy for bitcoin and ethereum as key portfolio assets reflects the growing acceptance and adoption of cryptocurrencies in mainstream finance. With their potential to navigate fiscal challenges and provide unique investment opportunities, bitcoin and ethereum are increasingly being seen as essential components of a diversified portfolio. As the cryptocurrency market continues to evolve and mature, investors can benefit from including digital assets in their investment strategy to capitalize on market trends and secure their financial future.