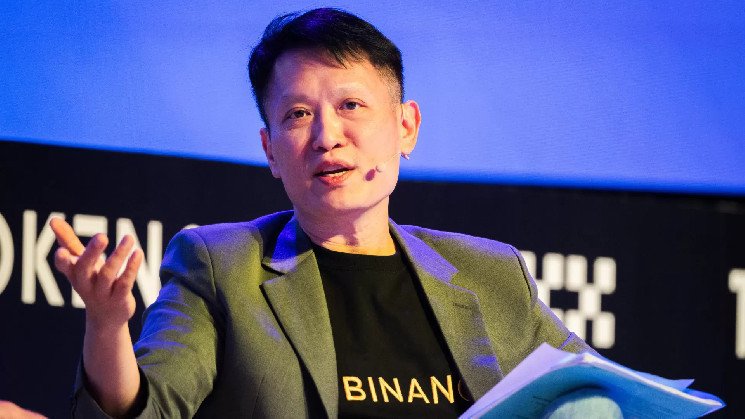

In a recent interview, Binance CEO Richard Teng discussed the evolving regulatory landscape for cryptocurrencies, particularly in light of the Trump administration’s “crypto-friendly” stance. Teng emphasized the importance of selecting crypto-friendly figures for key roles in regulation and described 2024 as a potential turning point for the industry, citing milestones such as Bitcoin’s price increase and the approval of ETFs for Bitcoin and Ethereum.

Teng highlighted Binance’s commitment to compliance efforts, noting the company’s investment of $230 million in compliance programs last year. He also discussed Binance’s global market strategies, stating that the company is currently licensed in over 20 countries and continues to work closely with U.S. regulators to enhance compliance programs. Teng emphasized compliance as a competitive advantage for Binance in the industry.

Regarding the Middle East market, Teng praised the region’s high crypto adoption rates, particularly in the UAE where adoption is around 40%. He commended Abu Dhabi’s early adoption of a crypto framework in 2018, positioning it as a global hub for blockchain and digital assets. Teng suggested that the Middle East is becoming increasingly important for Binance, indicating a focus on growth in the region.

When asked about the U.S. market and the potential introduction of a stablecoin framework, Teng described the discussion as premature and instead emphasized Binance’s global growth. He highlighted the company’s net inflows exceeding $20 billion this year and increasing institutional adoption. Teng also mentioned Binance’s $1 billion SAFU fund for user protection and ongoing efforts to combat scams and fraud.

As Binance continues to navigate the evolving crypto landscape, Teng expressed optimism about the future of the industry, particularly as more countries, institutions, and sovereign wealth funds embrace digital assets. He underscored the importance of compliance in Binance’s operations and reiterated the company’s commitment to working with regulators to enhance programs and ensure regulatory compliance.

In conclusion, Teng’s insights shed light on Binance’s approach to compliance, global market strategies, and the state of crypto adoption in different regions. Despite ongoing scrutiny by U.S. regulators, Teng remains optimistic about the future of the industry and sees potential growth opportunities in regions like the Middle East. Binance’s commitment to compliance and global operations positions the company for success as it navigates the evolving regulatory landscape for cryptocurrencies.