Bitcoin has recently dropped back from its all-time high of over $100,000, as BlackRock quietly confirmed a worrying bitcoin bombshell. The bitcoin price has plunged toward $90,000 per bitcoin due to the Federal Reserve’s concerns about the crypto market. Financial analysts are warning of a potential bitcoin price crash to $20,000 as global money supply drops by $4.1 trillion.

According to analysts from The Kobeissi Letter, there is a historical relationship between bitcoin prices and global money supply, with a lag of around 10 weeks. The money supply has dropped to $104.4 trillion, the lowest since August, after hitting a peak of $108.5 trillion in October. This could potentially trigger a significant correction in bitcoin prices over the next few weeks, leading to a pause in its red-hot run.

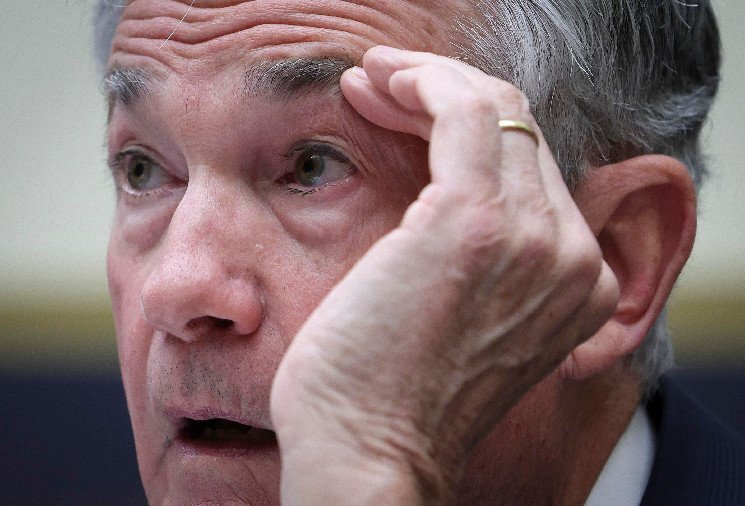

The Federal Reserve, which controls the money supply through monetary policy, has been trying to combat inflation while also reducing interest rates to prevent a recession. Despite recent rate cuts and signals of further cuts in the future, the Fed’s economic outlook suggests that inflation may be stickier than previously thought. This cautious approach to inflation could impact bitcoin prices, as monetary easing typically benefits bitcoin prices.

The U.S. debt has surged in recent years, reaching over $34 trillion at the beginning of 2024. The Covid pandemic and lockdown stimulus measures have contributed to massive government spending, leading to spiraling inflation in 2022. Inflation rates over 10% have forced the Federal Reserve to raise interest rates rapidly, increasing debt interest payments and fueling fears of a “death spiral.”

While the potential shift in Fed policy may put pressure on bitcoin prices, high interest rates will also strain the government’s debt payments. The ballooning federal government debt has raised concerns about its sustainability, with questions about the government’s credibility becoming a topic of interest in the market. Overall, the combination of factors such as inflation, interest rates, and government debt could impact the future trajectory of bitcoin prices.