ETF issuers in the United States are gearing up to launch spot Ethereum-based products next week. The final S-1 forms from prospective spot ETH ETF issuers have been submitted, marking a significant milestone in the approval process. Just two months ago, the chances of approval seemed slim, but now it looks like the launch date could be as early as July 23. This news comes as a surprise to many who had doubts about the approval of ETH ETFs.

Bloomberg ETF analyst James Seyffart provided a summary of the offerings from the nine spot Ethereum ETFs expected to launch next week. Of note is the fee structure, with major players like BlackRock and Fidelity charging just 0.25% in fees for their upcoming funds. In an effort to attract investors, BlackRock is offering a fee reduction for the first 12 months or $2.5 billion in assets gathered for its iShares Ethereum Trust (ETHA), while Fidelity will waive fees for its FETH fund until the end of the year. Other issuers such as Ark 21Shares and Bitwise are also offering competitive fee structures to attract investors.

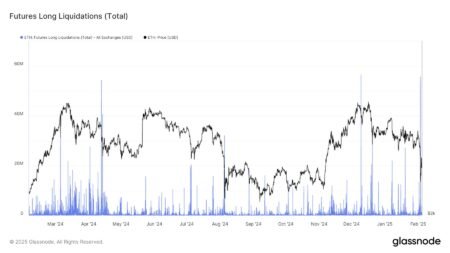

There is some concern surrounding what will happen to Grayscale’s Ethereum Trust given the significant outflow from its Bitcoin fund. Grayscale will charge a 0.25% fee for its mini ETH fund, and it has allocated 10% of its spot Ethereum ETF to establish the Ethereum Mini Trust with $1 billion in seed funding. Hodl Capital estimates that a similar exodus from Grayscale’s ETHE fund could result in up to $10 billion in assets under management being withdrawn. It remains to be seen how investors will react to the fee structures of these competing funds.

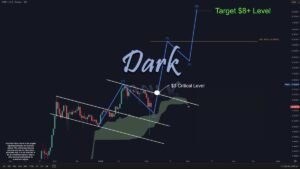

The price of Ethereum has seen a modest increase of over 10% in the past seven days, with the asset trading at just over $3,400 at the time of writing. Despite a recent high of $3,500, prices have since fallen slightly. There may be some price movement when the ETFs go live, but it is likely that much of this anticipation has already been factored into the current price. Investors will be closely watching the market to see how the launch of these ETFs impacts the price of Ethereum in the coming days.

In conclusion, the approval and impending launch of spot Ethereum ETFs in the United States have generated significant interest and excitement among investors. The competitive fee structures offered by issuers are indicative of the fierce competition expected in the ETF market. Concerns surrounding the potential impact on Grayscale’s Ethereum Trust highlight the uncertainties and challenges facing existing investment products. As the launch date approaches, all eyes will be on how the market reacts to the introduction of these new Ethereum-based investment opportunities.