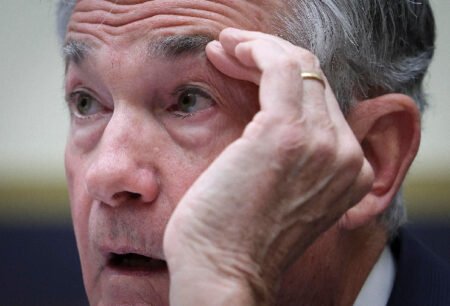

The recent statement from Fed Chair Jerome Powell made it clear that the Federal Reserve has no intentions of participating in any government plan to accumulate Bitcoin. Powell emphasized that such decisions fall under the jurisdiction of Congress and the Fed does not plan to push for changes in existing laws to allow for Bitcoin holdings. This announcement caused the market to react, with Bitcoin’s price quickly pulling back from its earlier high. The probability of a Bitcoin Strategic Reserve also dropped from 40% to 34% after Powell’s speech.

While the Fed does not have veto power over the establishment of a Bitcoin Strategic Reserve, the U.S. Congress holds the highest authority in the financial system. Congress is responsible for enacting regulations and authorizing agencies like the SEC and the Federal Reserve to carry out their functions. It is important to note that the Fed, although independent in monetary policy, cannot block the creation of a BSR.

The Trump administration could potentially establish a strategic bitcoin reserve through an executive order directing the U.S. Treasury to use the Exchange Stabilization Fund (ESF) to purchase Bitcoin. This approach would avoid the need for congressional approval but could face uncertainty in terms of sustainability as future administrations could reverse or amend the executive order.

For a more stable and long-term Bitcoin Strategic Reserve, congressional legislation would be necessary. Senator Cynthia Lummis has proposed the “U.S. Bitcoin Strategic Reserve Act,” which is currently under review by the Senate Banking Committee. This route would formally recognize Bitcoin as a national strategic asset but is more time-consuming as it requires approval from both the Senate and House of Representatives and the President.

Another option could be a collaboration between the Federal Reserve and the Treasury Department. The Federal Reserve could purchase Bitcoin through open market operations and add it to its balance sheet, while the Treasury Department could establish a special fund for Bitcoin investment as part of a fiscal plan, requiring congressional approval. However, the Federal Reserve’s recent statements make it seem unlikely that they will pursue this path.

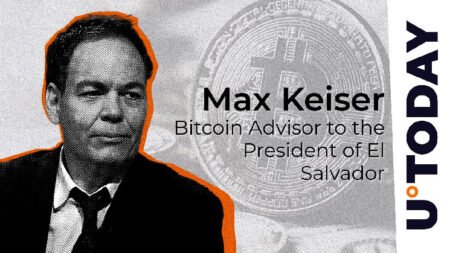

The Fed’s refusal to participate in the BSR proposal does not completely shut down the idea, as the Trump administration has shown support for it through potential action. The contrast between traditional power structures and market innovation is evident in the cautious approach of the Fed and the actions of the Trump family. Ultimately, the decision on a Bitcoin Strategic Reserve would lie with the Treasury Department, rather than the Federal Reserve.