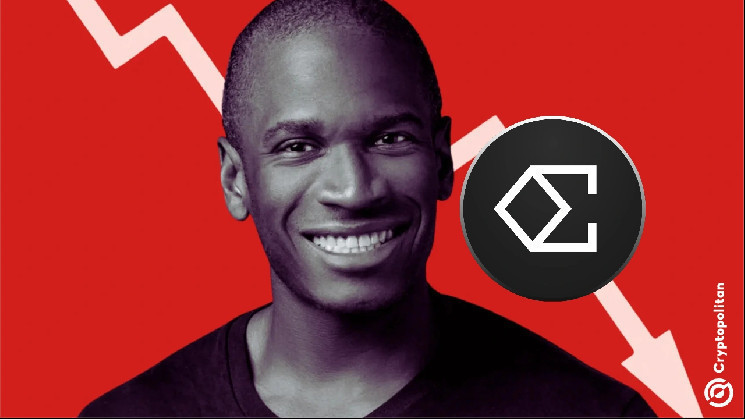

Arthur Hayes, the former CEO of BitMEX, recently made headlines in the cryptocurrency community by dumping $8.4 million worth of Ethena’s ENA tokens on Binance just two hours after praising the project in a tweet. Between November 26 and 28, he quietly built up a position of 16.79 million ENA tokens at $0.67 per token, making a profit of $7.7 million by cashing out when the token reached $0.7015.

Despite the dump, Arthur still holds 9.96 million ENA tokens valued at $11.7 million, with 7.94 million staked. His current holdings have already delivered an overall profit of $8.71 million, up 78%. The token had experienced a surge of over 25% in a week before the dump, reaching $0.7015 on December 21, driven by rising demand and speculation.

Ethena’s synthetic dollar, USDe, has been a key feature of the platform, generating a 67% yield for stakers in one week and making traditional stablecoins like Tether appear outdated. Arthur’s endorsement of the project added credibility, but his actions later sparked chaos and allegations of insider trading and market manipulation, a recurring theme in his career.

Arthur’s reputation as a sharp trader comes with legal baggage, as BitMEX faced accusations of running an “Insider Trading Desk,” allowing employees to profit from private customer data. The platform was also accused of manipulating index prices to trigger liquidations, leading to lawsuits and regulatory scrutiny from the CFTC and DoJ, alleging violations of the Bank Secrecy Act.

Despite the controversies surrounding Arthur and BitMEX, the cryptocurrency community continues to follow his moves, as his endorsement of projects like Ethena can impact market sentiment. While his actions may rattle confidence, his history as a successful trader and entrepreneur cannot be denied, making him a polarizing figure in the industry.

In conclusion, Arthur Hayes’s recent dump of Ethena tokens on Binance has once again stirred controversy in the cryptocurrency community, with many questioning his motives and integrity. While his actions may have sparked chaos and allegations of market manipulation, his history as a successful trader and entrepreneur cannot be overlooked. As the cryptocurrency market continues to evolve, players like Arthur will remain under scrutiny, facing both praise and criticism for their actions.