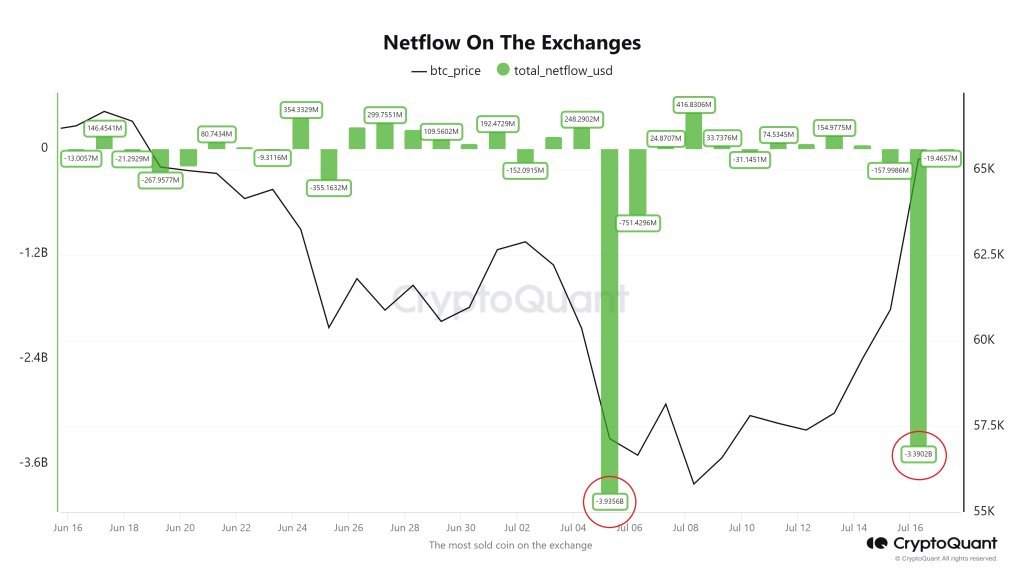

Bitcoin is currently holding steady, hovering above key support levels and approaching the crucial local liquidation line at around $66,000. Despite this stability, there are significant developments in the crypto market that may support a potential price increase. One such development is the withdrawal of billions worth of BTC from exchanges by holders, indicating a strong bullish sentiment. When prices plummeted on July 5, leading to a drop in Bitcoin’s value to close to $50,000, a massive $3.8 billion worth of BTC was moved from exchanges. This move coincided with a rapid price recovery, with Bitcoin bouncing back to $65,000.

Even though the recent withdrawals of BTC from exchanges have not had a direct impact on prices, historical data suggests that such actions tend to lead to a price increase in the future. When coin holders transfer their assets to non-custodial wallets, it indicates a desire to hold onto their coins and avoid selling them immediately. This reduced availability of BTC on exchanges contributes to increased scarcity, benefiting bullish investors in the long run. As more BTC is being withdrawn from exchanges, there is a possibility of prices climbing higher, similar to the recovery seen after the drop to $53,500.

Another positive indicator for Bitcoin’s price potential is the fall in the Realized Profit and Loss Ratio metric to multi-month lows. This metric reflects the sentiment of investors based on profits and losses in the market. The decline suggests that investors who aimed to sell at higher prices have already cashed out, reducing the selling pressure in the market. Traders are now awaiting a possible rise in this metric, potentially surpassing levels above $72,000 and $74,000 before profit-taking resumes.

Additionally, Bitcoin has reclaimed its average cost basis for short-term holders (STHs) as prices recover above $62,000. This means that investors who bought Bitcoin within the last 155 days are now in a profitable position and may be holding onto their assets in anticipation of further gains. Historically, when the average cost basis is surpassed, prices tend to rise by over 30%, indicating a potential price surge in the near future. Overall, these developments suggest a positive outlook for Bitcoin’s price trajectory in the coming weeks.

In conclusion, the recent withdrawals of significant amounts of BTC from exchanges, the decline in the Realized Profit and Loss Ratio metric, and the reclaiming of the average cost basis for short-term holders are all promising signs for Bitcoin’s price potential. These indicators point towards a potential price increase above $72,000 and $74,000, with historical data supporting the likelihood of a substantial price surge. As Bitcoin continues to consolidate above key support levels, investors and traders are optimistic about the possibility of another leg up for the world’s most valuable cryptocurrency. With bullish sentiment prevailing in the market, Bitcoin may be on track to reclaim its previous highs and push towards new all-time highs in the near future.