Bitcoin’s price soared to a multi-week peak of $66,000 before being pushed back down by the bears, causing the cryptocurrency to lose over $1,000 from its highest point. This sudden drop comes after a period of recovery for Bitcoin, which had fallen below $54,000 at the beginning of the month but quickly bounced back to $58,000 and continued to climb, reaching $63,000 on Monday.

The spike in Bitcoin’s price was attributed to growing ETF inflows and positive market sentiment following an assassination attempt against pro-crypto US presidential candidate Donald Trump. However, the bulls were unable to maintain the momentum, and Bitcoin’s gains were halted at $66,000. Currently, the cryptocurrency is trading at just under $65,000, with a market cap of $1.280 trillion and dominance over the altcoins above 51% on CG.

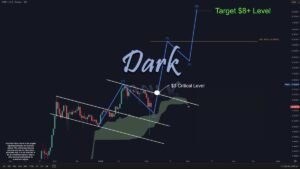

While Bitcoin faced a slight setback, the altcoin market has also experienced a shift in trend, with top performers like XRP and SHIB retracing significantly. Ripple’s native token, XRP, saw a 6% daily retracement, dropping to $0.57, while SHIB, the second-largest meme coin, lost 8.3% of its value and now trades at $0.000017. Other popular altcoins like ETH, DOGE, AVAX, DOT, LINK, and UNI are also in the red following the market correction.

The total cryptocurrency market cap, which reached a multi-week peak yesterday, has dropped by $40 billion to $2.490 trillion on CG. Despite the recent retracement in prices, the overall sentiment remains positive in the crypto market, with investors continuing to show interest in digital assets. While Bitcoin’s price may have temporarily dipped, it is likely to see further movement in the coming days as market dynamics evolve.

Investors and traders are advised to closely monitor the market trends and stay informed about any potential developments that could impact the price of cryptocurrencies. With the increasing adoption of digital assets and growing interest from institutional investors, the cryptocurrency market is expected to remain volatile but potentially lucrative for those willing to navigate the fluctuations. As always, it is essential to exercise caution and conduct thorough research before making any investment decisions in the volatile crypto market.