Northern Data Group has reported a significant decline in net revenue for the 2023 fiscal year, dropping to €77.5 million from €193.3 million in 2022. Despite this decrease, the company’s total income for the period was reported at €111.0 million, compared to €249.5 million in the previous year. This decline in revenue was attributed to substantial investments in high-performance computing (HPC) applications and infrastructure, resulting in an adjusted EBITDA of -€5.5 million, in line with market expectations.

The company has ambitious growth plans for the coming years, with expectations to triple its revenue to €200 million and €240 million in 2024. Further growth is projected in 2025, with a potential doubling of revenue to reach €520 million to €570 million. To support this growth, Northern Data announced plans to invest €140 million in its Bitcoin mining company, Peak Mining, as well as €730 million in NVIDIA H100 Tensor Core GPUs and €110 million to expand its data center footprint in the US and EU.

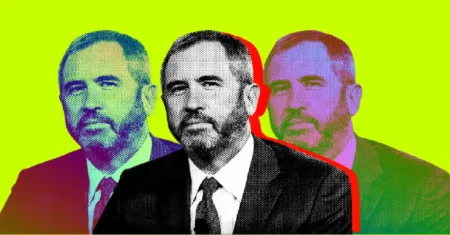

Founder and CEO, Aroosh Thillainathan, described 2023 as an “inflection point” for Northern Data, focusing on establishing the company in AI and high-performance computing and making strategic investments for 2024. He emphasized that the company is well-capitalized with significant cash reserves. The group’s strong position in the market is further highlighted by their status as the largest Bitcoin miner in Europe, producing 2,298 BTC in 2023 through Peak Mining activities.

Peak Mining’s strategy involves mining Bitcoin for its own account and selling all mined coins daily. By increasing its self-mining hardware devices by 10% to 40,643 installed devices and 3.78 exahashes per second (EH/s) in May 2023, the company demonstrated its commitment to expanding its mining operations. By the end of 2023, Peak Mining had installed 35,639 self-mining ASIC servers with a hash rate of 3.34 EH/s, shutting down sites with high energy costs to optimize operations.

In a move that signals further expansion and growth, Northern Data is reportedly considering an initial public offering (IPO) in the US with an expected valuation between $10 and $16 billion. This potential IPO would not only raise significant funds for the company but also increase its visibility and market presence. With a clear focus on AI, high-performance computing, and strategic investments in Bitcoin mining and data center infrastructure, Northern Data is poised for continued growth and success in the coming years.