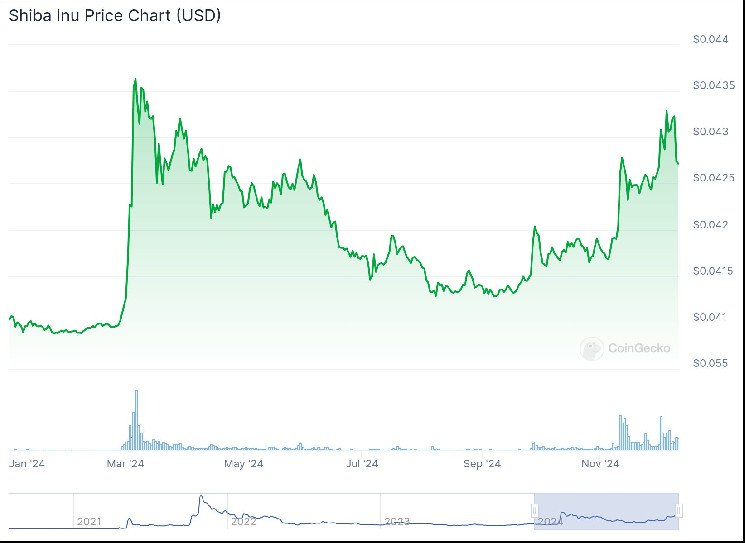

Predicting the top of a crypto market cycle is a blend of art and science, involving various tools and indicators. One prominent event in the crypto world is the Bitcoin halving, which occurs approximately every four years and marks the reduction in network emissions. This event is often seen as a signal for the beginning of greed and speculation in crypto markets, with each cycle tending to peak around 12-18 months after the halving. As of April 2024, eight months into the latest halving, historical data suggests that the 2024 cycle still has room to grow.

Another tool that crypto investors rely on is the Google search for ‘bitcoin’. This simple indicator tracks the public’s interest in bitcoin, with peaks in search interest often preceding actual price tops by several months. The Pi Cycle Top indicator is a quantitative measure based on bitcoin’s price moving averages and has shown fair accuracy in predicting cycle tops in past bull cycles. The indicator operates on the premise that market euphoria drives prices to unsustainable levels, causing significant deviations from long-term growth trends.

App Store rankings provide a qualitative measure of sentiment among retail investors, with Coinbase’s ranking serving as an indicator of market cycles. When Coinbase ranks highly on App Store rankings, it is believed that the top of the cycle is near. Similarly, the ETH:BTC ratio is a measure investors obsess over, indicating the shift from bitcoin to riskier altcoins. However, with Ethereum’s sentiment currently low, the ETH:BTC ratio may not hold the same value as in previous cycles. The ratio is currently at 0.034, with past peaks reaching 0.075 in 2022 and 0.0109 in 2018.

Overall, these tools and indicators offer insights into the dynamics of crypto market cycles, helping investors make informed decisions. While none of these measures can guarantee success, they serve as valuable tools in predicting market trends. As crypto investing continues to evolve and attract new participants, these indicators provide a glimpse into the shifting landscape of digital assets. By understanding and utilizing these tools effectively, investors can navigate the volatile crypto market with more confidence and clarity. Subscribe to 0xResearch newsletter for more insights and updates on crypto market trends and developments.