The recent pullback in the crypto market, driven by the U.S. Fed’s rate cut decision, has led to Bitcoin prices dropping below $95,000. However, despite this correction, major institutions worldwide are actively accumulating BTC, setting the stage for a quick recovery. The market sentiment seems to be leaning towards a buy-the-dip strategy, with Bitcoin’s market cap currently at $1.89 trillion and a 24-hour trading volume of $63 billion.

The increasing adoption of Bitcoin and the active accumulation trend by large holders suggest that the asset is poised to bounce back to $100k. The Fibonacci retracement levels indicate that $86k and $79k are crucial support levels for Bitcoin holders. With the coin price above a 200-day exponential moving average and 50% FIB, there is a broader bullish trend in play, potentially signaling a bullish rally in the near future.

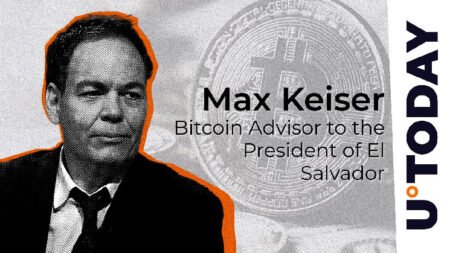

The global Bitcoin adoption trend has been on the rise, with countries like El Salvador and major companies like MicroStrategy actively accumulating BTC. El Salvador recently purchased 29 BTC, bringing its total holdings to 5,995 BTC. Japanese firm Metaplanet acquired 619.7 BTC, MicroStrategy bought 5,262 BTC, and Matador Technologies allocated $4.5 million into Bitcoin. This accumulation by major players reinforces Bitcoin’s credibility as a long-term store of value and could contribute to a quick recovery in its price.

The recent Bitcoin price pullback tested Fibonacci support levels, with the price dropping from $108,350 to $92,912. The pullback led to a bearish breakdown from the rising channel pattern and a loss of the 20-day EMA and 23.6% FIB support level, increasing selling pressure in the market. If the correction continues, Bitcoin could potentially drop further to reach the 38.2% FIB at $86k or the 50% FIB at $79k. However, these levels could also serve as opportunities for the price to regain bullish momentum and potentially rally past $100k.

Overall, the market sentiment for Bitcoin remains positive despite the recent pullback, with major institutions actively accumulating the asset and setting it up for a quick recovery. The increasing global adoption of Bitcoin as a reserve asset by countries and companies further reinforces its credibility and legitimacy. With key support levels in place and a buy-the-dip sentiment prevailing, Bitcoin could potentially see a rapid rebound and stabilize above $100k in the near future.