Tech visionary Balaji Srinivasan, known for his roles at Coinbase and Andreessen Horowitz, recently shared two charts highlighting the rapid growth of AI large language models (LLMs) and Bitcoin ETFs. According to Srinivasan, both AI and Bitcoin are currently in their “vertical” growth phases, indicating a significant increase in opportunities and adoption.

In the first chart, Srinivasan demonstrates the potential of OpenAI’s flagship models to solve various tasks, measured by the Abstraction and Reasoning Corpus for Artificial General Intelligence (ARC-AGI) benchmarks. The latest o3 model from OpenAI achieved a record-breaking 87.5% on the ARC-AGI public data set, surpassing GPT-4o by 10x in terms of performance. This marks a significant improvement over GPT-3, the model that sparked the AI hype in 2023.

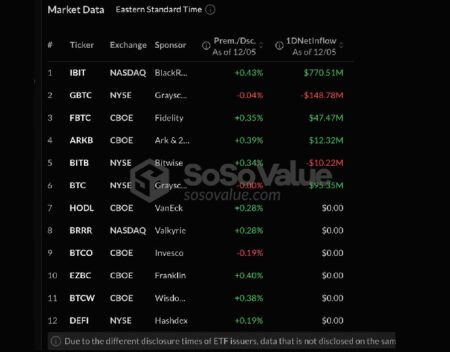

The second chart presented by Srinivasan illustrates the growth dynamics of USD-denominated assets under management (AUM) for BlackRock iShares ETFs on Gold and spot Bitcoin. Within less than a year of their launch, BlackRock’s Bitcoin spot ETFs have exceeded their Gold-based predecessors by almost 73%, totaling $57.8 billion in AUM compared to Gold-based products at $33 billion. The approval of Bitcoin spot ETFs in the U.S. on Jan 11, 2024, has led to the accumulation of $113 billion in AUM across 21 products.

Commenting on Srinivasan’s analysis, tech veteran Alan Knitowski pointed out that Bitcoin’s growth may be outpacing that of the internet. Knitowski’s chart suggests that Bitcoin’s adoption is currently at levels comparable to the global web in 1999, despite having less than 1 million BTC addresses. This highlights the rapid pace at which Bitcoin is gaining traction and market adoption.

Overall, Srinivasan’s charts demonstrate the increasing opportunities within the AI and Bitcoin sectors, with both showing significant growth potential and adoption rates. The data presented by Srinivasan reinforces the belief that AI and Bitcoin are on a trajectory of vertical growth, opening up new possibilities for innovation and investment in these emerging technologies. As both industries continue to evolve and expand, it will be interesting to see how their growth trajectories impact the broader technology landscape in the coming years.