Bybit, a Dubai-based cryptocurrency exchange, has quickly risen to become the world’s second-largest, taking advantage of the void left by the collapse of FTX and the broader recovery in the crypto market. The exchange offers margin trading services that accept digital tokens as collateral, filling the gap left by FTX’s downfall. Bybit’s trading volume share has doubled to 16% since October, surpassing industry giant Coinbase Global Inc. and trailing only Binance Holdings Ltd. in global rankings for spot and derivatives transactions, according to Kaiko data. The exchange’s growth coincides with a broader recovery in the cryptocurrency market, driven by Bitcoin’s price surge and the introduction of dedicated U.S. exchange-traded funds.

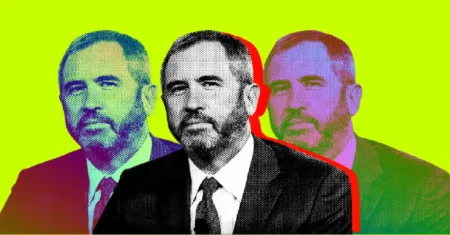

Bybit’s Chief Executive Officer Ben Zhou attributes the exchange’s rapid ascent to strategic targeting of European markets, which currently account for 30%-35% of its trading volumes. Additionally, the Commonwealth of Independent States, notably Russia, represents approximately one-fifth of Bybit’s business. Despite operating under scrutiny in Russia, Bybit maintains strict sanctions compliance and is expanding its presence in neighboring Georgia and Kazakhstan. The exchange has also ventured into new markets, including Brazil, Turkey, and various African nations, amidst evolving regulatory landscapes in Europe under the Markets in Crypto Assets (MiCA) regulation framework. Bybit recently extended its services to Chinese expatriates with legal assessments indicating low risks despite China’s crypto trading ban.

Recognizing the regulatory challenges in the industry, Bybit is reassessing its operations with prime brokers to enhance compliance standards. With over 30 million users globally since its establishment in 2018, Bybit continues to expand its footprint with upcoming offices in the Netherlands, emphasizing its global growth strategy. Bybit’s rapid rise showcases the changing dynamics in the crypto exchange landscape, driven by strategic market targeting and regulatory compliance efforts amid evolving global financial standards.

It is important to note that the information presented in this article is for informational and educational purposes only and does not constitute financial advice. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.